When evaluating a business’s financial health, understanding revenue vs profit is crucial. Revenue refers to total sales income, while profit is what’s left after expenses. Knowing the difference helps you gauge a company’s true performance. This article breaks down these concepts and their importance.

Key Takeaways

- Revenue is the total income from sales before expenses, while profit is the net income after all expenses are deducted, highlighting a company’s financial health.

- Understanding the types and factors influencing revenue and profit is essential for a comprehensive financial analysis and informed decision-making.

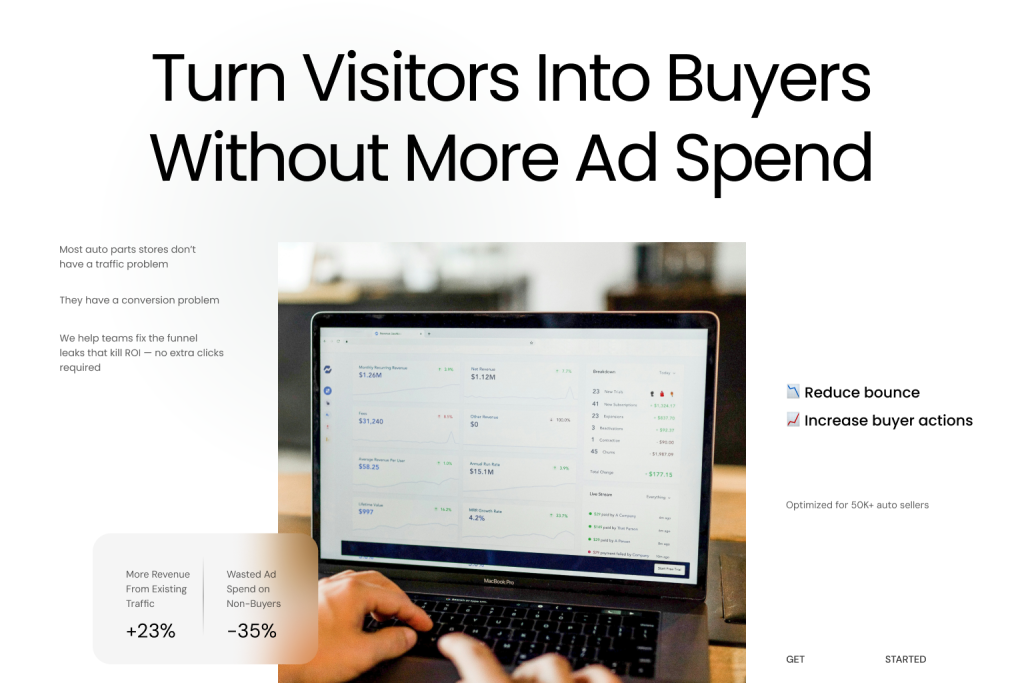

- High revenue does not guarantee high profit; effective cost management and operational efficiency are critical for maximizing profitability.

Revenue vs. Profit: The Essentials

Revenue is the lifeblood of any business, representing the total income generated from sales before any expenses are deducted. It is often viewed as the top-line figure on an income statement, showcasing the gross revenue a company brings in from its core business operations. On the other hand, profit, often referred to as the bottom line, is the net income that remains after all expenses—including operating costs, taxes, and interest—have been subtracted from total revenue. This distinction is crucial because it highlights the difference between income generated and earnings retained, offering a clearer picture of a company’s financial health. Analyzing both revenue and profit is essential for evaluating a company’s financial health and understanding its financial position, as these metrics reveal how well a company manages its resources and obligations.

Grasping the difference between revenue and profit is key to evaluating a company generates financial performance. While high revenue indicates strong market demand and successful sales strategies, it does not guarantee profitability. A company with soaring revenues can still experience losses if its operating expenses exceed its income.

Therefore, a comprehensive analysis of both revenue and profit is necessary to gain insights into a business’s financial health and make informed decisions about a business’s financial performance. These metrics collectively reflect the company’s financial performance and position, providing a holistic view of its economic well-being.

What Is Revenue?

Revenue represents the total income generated from sales before any expenses are deducted and is often called the top-line income on an income statement. One of the primary ways businesses generate revenue is by selling goods, which involves trading products for income and is a key driver of financial results. It is a critical indicator of a company’s ability to generate sales and attract customers, providing insights into business growth and product demand. Revenue appears at the very top of the income statement, highlighting its role as the starting point for understanding a company’s financial performance.

Revenue can be influenced by various factors, such as market demand, pricing strategies, and sales volume. Distinguishing between different types of revenue is crucial for a comprehensive understanding of a company’s income. The subsequent subsections will delve into these types and the factors influencing revenue growth.

Types of Revenue

Revenue comes in various forms, each providing unique insights into a company’s financial health. Gross revenue, for instance, is the total inflow from sales without accounting for any deductions for returns or discounts. This figure gives a broad view of the business’s sales performance but doesn’t reflect the actual income retained.

Net revenue, on the other hand, is calculated by subtracting returns and discounts from gross revenue, offering a clearer picture of the actual income generated. The resulting figure is also referred to as net sales, which accurately reflects the revenue from sales activities. The company’s net revenue plays a crucial role in determining gross profit, as it serves as the basis for calculating profitability after accounting for the cost of goods sold. Operating revenue is derived from a company’s primary business activities, such as sales of products or services, while non-operating revenue comes from ancillary activities like investments or rental income. Non-operating revenue sources include asset sales, investment income, and interest income. Additionally, the company’s net revenue provides insight into overall financial health.

A comprehensive financial analysis requires understanding these different types of revenue, as each offers insights into various aspects of a company’s operations and financial performance.

Factors Influencing Revenue

Market demand is a significant factor that directly affects a company’s revenue growth. When demand for a company’s products or services is high, sales volume increases, leading to higher revenue. Pricing strategies also play a crucial role; competitive pricing can attract more customers, boosting sales revenue. Average revenue per user or unit is often used to assess predictable income and to calculate recurring revenue metrics such as ARPU, MRR, and ARR.

Conversely, high prices might deter customers unless justified by high-quality offerings or unique features.

Competition is another critical factor. In a highly competitive market, unique features or superior quality can attract more customers, positively impacting boosting revenue. Economic conditions, such as recessions or demographic shifts, can also influence revenue. For instance, during economic downturns, consumer spending typically decreases, which can adversely affect a company’s revenue despite competitive efforts.

What Is Profit?

Profit is the amount of money that remains after all business expenses have been deducted from total revenue. It’s a crucial indicator of a company’s true earnings and overall financial health. Unlike revenue, which only shows the total income generated, profit reflects the efficiency of cost management and operational effectiveness. It provides a clearer picture of a company’s financial viability and long-term sustainability. Analyzing different types of profit—gross, operating, and net profit—is essential for evaluating a company’s profitability and operational efficiency.

There are three primary classifications of profit: gross profit, operating profit, and net profit. Each type offers different insights into a company’s financial performance and is analyzed at various levels based on the costs subtracted from revenue. A detailed financial analysis requires understanding these types of profit, which will be explored further in the following subsections.

Types of Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, indicating the efficiency in producing or delivering products or services. It also reflects trends in sales and production costs, providing insights into the core business operations.

Operating profit, called operating income, is the income remaining after subtracting operating expenses from gross profit. It shows how much money was spent running the business and is crucial for understanding operational costs efficiency.

Net profit, or net income, demonstrates how well the business is performing overall. It accounts for all expenses, including operating costs, taxes, and interest, providing the most comprehensive view of a company’s financial health. Net profits serve as a comprehensive indicator of a company’s overall profitability and financial health, as they show the remaining profit after all deductions. A higher net profit reflects effective cost management and operational success. Each type of profit offers valuable insights, making it essential to analyze all three for a complete financial assessment. If expenses exceed revenue, a company may report a net loss, which indicates bottom-line profitability issues.

Factors Affecting Profit

Cost management is a critical factor affecting profit. Efficiently controlling internal expenses and resource allocation can significantly impact profit margins. Managing both fixed and variable expenses is crucial when calculating net profit. Operational efficiency, which involves minimizing waste and improving productivity, directly influences profitability by reducing costs. Key factors impacting net profit include total operating expenses, such as administrative costs, property taxes, salaries, rent, marketing, and utilities. Employing effective tax strategies is also essential, as it determines the actual profit retained after tax liabilities are paid.

Interest rates can affect profit margins as well. Higher interest rates increase borrowing costs, thereby reducing overall profitability and increasing interest expenses. Grasping these factors is vital for managing a company’s financial performance and ensuring long-term success.

Calculating Revenue and Profit

Calculating revenue and profit involves several steps, each crucial for accurate financial planning. The initial step in calculating profit is to start with revenue, ensuring that all income generated from sales is accounted for. To calculate profit, you use the company’s income statement by first identifying total revenue at the top, then subtracting the cost of goods sold and operating expenses to arrive at net profit near the bottom. Accurate calculations are vital for financial reports and decision-making processes, as they provide a clear view of a company’s financial health. Certain revenue and expense items are reported separately on the company’s income statement for accounting and tax purposes.

The following subsections will delve into the specific steps for calculating total revenue, gross profit, and net profit, providing a comprehensive guide to understanding these essential financial metrics.

Calculating Total Revenue

Total revenue is determined by taking the number of units sold. This figure is then multiplied by the price per unit. This figure represents the gross revenue before any adjustments. However, total revenue can be adjusted downward to account for returns and discounts, which affect the final sales figures.

Accurate calculation of total revenue is critical for understanding a company’s sales performance and planning how to calculate revenue for future strategies.

Calculating Gross Profit

To calculate gross profit, you need to subtract the cost of goods sold (COGS) from total revenue. This formula helps determine a company’s profitability and profit margin. This metric indicates the profitability of core business operations by showing the earnings left after covering the production costs. It is a key financial metric for assessing the efficiency and productivity of a company’s operations.

Calculating Net Profit

Net profit reflects the earnings remaining once all operating costs and taxes paid, and interest have been deducted from gross profit. This figure provides the most comprehensive view of a company’s financial performance, highlighting its ability to generate profit after covering all expenses.

Accurate calculation of net profit is essential for evaluating a business’s overall financial health and sustainability.

Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is a vital metric for companies, especially those operating with subscription-based or SaaS business models. ARR represents the predictable, recurring income a company earns each year from its ongoing customer subscriptions or contracts. This figure is crucial for understanding revenue trends and forecasting future financial performance, as it provides a clear picture of the company’s stable income stream.

To calculate ARR, businesses typically multiply their monthly recurring revenue (MRR) by 12. This straightforward calculation offers a comprehensive view of the company’s annual revenue stream, making it easier to plan for growth, allocate resources, and attract investors. Monitoring annual recurring revenue (ARR) helps companies identify patterns in customer retention, spot opportunities for upselling, and make informed decisions about scaling their operations. Ultimately, ARR is a key indicator of a company’s financial health and long-term stability.

Key Differences Between Revenue and Profit

Revenue encompasses all earnings from sales, while profit is the amount left after all expenses are deducted. This distinction is crucial because revenue indicates the total income generated, whereas profit reveals the actual earnings retained. Recognizing these differences is crucial for assessing a company’s financial health and making informed decisions.

Many believe that revenue growth always signifies business success, but profitability, customer satisfaction, and market share also critically factor into a company’s overall performance. It’s often thought that high revenue automatically equates to high profitability, but significant costs can lead to minimal or negative profits. Therefore, analyzing both revenue and profit is necessary for a comprehensive financial assessment.

Financial Statements Placement

Revenue is reporting revenue at the top of the company’s income statement, showcasing the total income generated from sales. Profit appears at the bottom of the income statement, reflecting the earnings remaining after all expenses are deducted.

This placement highlights the flow of financial information and provides insights into a company’s financial position.

Importance for Decision Making

Revenue provides insights into market demand and sales performance, while profit is a key indicator of a business’s overall financial health. Both metrics work together to inform business strategies and operational adjustments.

Both revenue and profit are critical for effective decision-making and long-term business success.

Financial Performance Metrics

Financial performance metrics are essential tools for evaluating a company’s financial health and overall performance. These metrics, which include gross profit, net profit, operating profit, and net income, provide valuable insights into how effectively a business generates revenue, controls costs, and maintains profitability. By regularly reviewing these figures on income statements, companies can assess their operational efficiency and identify areas that need improvement.

Gross profit measures the income remaining after subtracting the direct costs of goods sold, while operating profit accounts for operating expenses to show the earnings from core business activities. Net profit, or net income, reflects the company’s total earnings after all expenses, including taxes and interest, have been deducted. Together, these financial performance metrics help investors, analysts, and business leaders gauge a company’s financial position and make strategic decisions to support future growth and success.

Examples of Revenue vs. Profit

Consider a boutique hotel that generated a gross revenue of $105,000 from room bookings. After deducting the total cost of goods sold (COGS) of $23,000, the hotel’s gross profit is $82,000. However, after accounting for all operating expenses, the hotel reported a net profit of $80,000. This example illustrates how high revenue does not necessarily translate into high profit.

In another scenario, a business reported net revenue of $500,000 for the quarter and a profit of $100,000 after all the expenses were deducted. This highlights the importance of managing all the expenses, especially when a business incurs operating expenses, to ensure profitability, even with high revenue figures.

Revenue and Profit Analysis

Revenue and profit analysis is a cornerstone of financial statement analysis, enabling businesses to gain a deeper understanding of their financial performance. By examining revenue and profit margins, companies can identify trends, evaluate the effectiveness of pricing strategies, and assess the impact of cost structures on overall profitability. This analysis helps pinpoint strengths and weaknesses in operations, guiding management in making data-driven decisions.

A thorough revenue and profit analysis allows businesses to uncover opportunities to increase revenue, optimize profit margins, and streamline operations. It also supports strategic planning by highlighting areas where costs can be reduced or where additional investment may yield higher returns. Ultimately, analyzing revenue and profit is essential for maintaining a healthy financial position and driving long-term business growth.

How Revenue and Profit Work Together

Revenue drives business expansion by providing the necessary funds for growth initiatives. Revenue growth reflects demand and market expansion, which are crucial indicators of a business’s growth. However, profit ensures long-term viability by reflecting the true earnings after all expenses are covered. Both metrics are unique to each business and work together for overall success. Annual recurring revenue (ARR) helps businesses forecast future financial performance, highlighting the need for balancing revenue generation with profit management.

Some assume that merely cutting costs will enhance profitability, overlooking that strategic investments in business’s growth are also necessary for long-term success. Therefore, businesses should prioritize both revenue and profit to achieve sustainable growth. Tracking both revenue and profit is essential for monitoring the business’s financial health.

Business Strategy and Revenue

A robust business strategy is fundamental to achieving sustained revenue growth and strong profit margins. To be effective, a company’s revenue strategy should align with its broader business objectives and be tailored to its target market, industry dynamics, and competitive environment. By developing a comprehensive approach, businesses can identify and capitalize on opportunities to boost revenue, such as expanding product lines, entering new markets, or enhancing sales and marketing efforts.

In addition to focusing on revenue growth, companies must also prioritize operational efficiency and cost management to improve profit margins. This includes optimizing processes, reducing unnecessary expenses, and leveraging technology to streamline operations. By balancing initiatives to boost revenue with efforts to control costs, businesses can enhance their profitability and secure a competitive advantage in the marketplace.

Long-Term Success and Profit

Sustained profitability also relies on innovation, investment in new products or services, and the flexibility to respond to shifts in customer demand or competitive pressures. By prioritizing long-term financial performance and making strategic investments, companies can build a solid foundation for sustainable growth, increase shareholder value, and maintain a strong position within their industry.

Common Misconceptions About Revenue and Profit

Grasping the distinctions between revenue and profit, including the implications of non-operating income, is vital for sound financial decision-making.

Summary

Understanding the key differences between revenue and profit is crucial for evaluating a company’s financial health and making informed decisions. Revenue represents the total income generated from sales, while profit reflects the net earnings after all expenses are deducted. This distinction is vital for stakeholders, investors, and anyone involved in financial planning.

Revenue provides insights into market demand and sales performance, while profit highlights operational efficiency and cost management. Both metrics are essential for a comprehensive financial analysis and effective decision-making. Balancing revenue generation with profit management is crucial for long-term business success.

In conclusion, a thorough understanding of revenue and profit, along with accurate calculations and analysis, is necessary for assessing a company’s financial performance. By applying these insights to your financial strategies, you can make informed decisions that drive business growth and sustainability.

Frequently Asked Questions

What is the difference between revenue and profit?

Revenue is the total income from sales, while profit is the amount left after all expenses have been deducted from that revenue. Understanding this distinction is crucial for evaluating a business’s financial health.

How do you calculate total revenue?

To calculate total revenue, multiply the number of units sold by the price per unit. This gives you the gross revenue before accounting for any returns or discounts.

What are the types of profit?

The types of profit are gross profit, operating profit, and net profit. Each category represents different stages of earnings after deducting relevant costs and expenses.

Why is understanding both revenue and profit important for decision-making?

Understanding both revenue and profit is essential for informed decision-making as revenue reveals sales performance and market demand, while profit reflects the overall financial health of the business. Utilizing these metrics helps in shaping effective strategies and operational adjustments.

Can a company with high revenue still be unprofitable?

Absolutely, a company can generate high revenue yet remain unprofitable if its expenses exceed its income. This scenario highlights the importance of managing costs effectively to ensure financial health.